Zeta’s 2025 Vision

Pro-Level Exchange (Like Hyperliquid) Built on Solana

The Vision

Why Hyperliquid Won Cryptos Hearts and Minds

The Traders’ Chain

Why Solana’s Infra Falls Short

Solana's Existing Exchange Models

The Solution: Zeta X

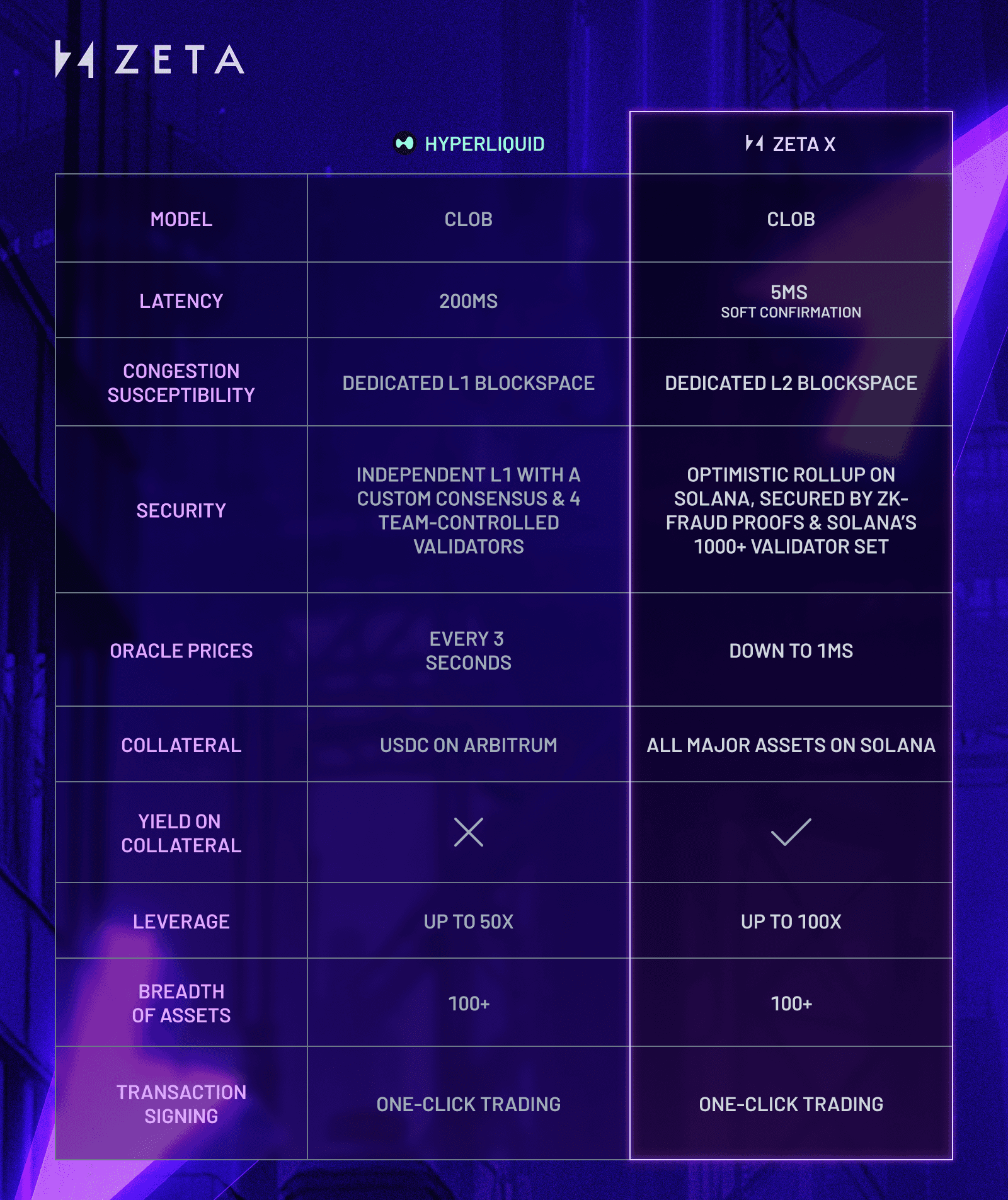

How Zeta X Will Stack Up to Hyperliquid

🔗 Zeta’s 2025 Vision: Pro-Level Exchange (Like Hyperliquid) Built on Solana

2024 was a transformative year for the perps landscape, with one standout story: Hyperliquid’s meteoric rise. This growth highlights two key insights:

There is significant demand for professional-grade DeFi trading experiences.

DEXs now have the tech to truly compete with CEXs.

Yet, amidst this evolution, Solana has struggled to keep pace—and we’re determined to change that in 2025.

Why Hyperliquid Won Cryptos Hearts and Minds:

Lightning-Fast Trading: With 200ms latency, trading on Hyperliquid is orders of magnitude faster than most DEXs.

Purpose-Built Appchain: An independent L1 appchain eliminates congestion.

Opportunities: Better than CEX asset variety, liquidity and leverage gives traders the tools they need to make money.

Innovative Airdrop Strategy: In arguably the best airdrop of 2024, they were brave enough to spearhead a new token launch strategy that keeps traders on-chain.

But there’s a catch for many traders: Hyperliquid isn’t on Solana. And as Solana solidifies its position as the venue for on-chain traders this cycle, this gap presents both a challenge—and an opportunity.

Solana: The Traders’ Chain, But With Challenges to Overcome

Solana has long been the leader in on-chain derivatives technology, outperforming other L1s and L2s with unmatched capacity for central limit order book (CLOB) infrastructure.

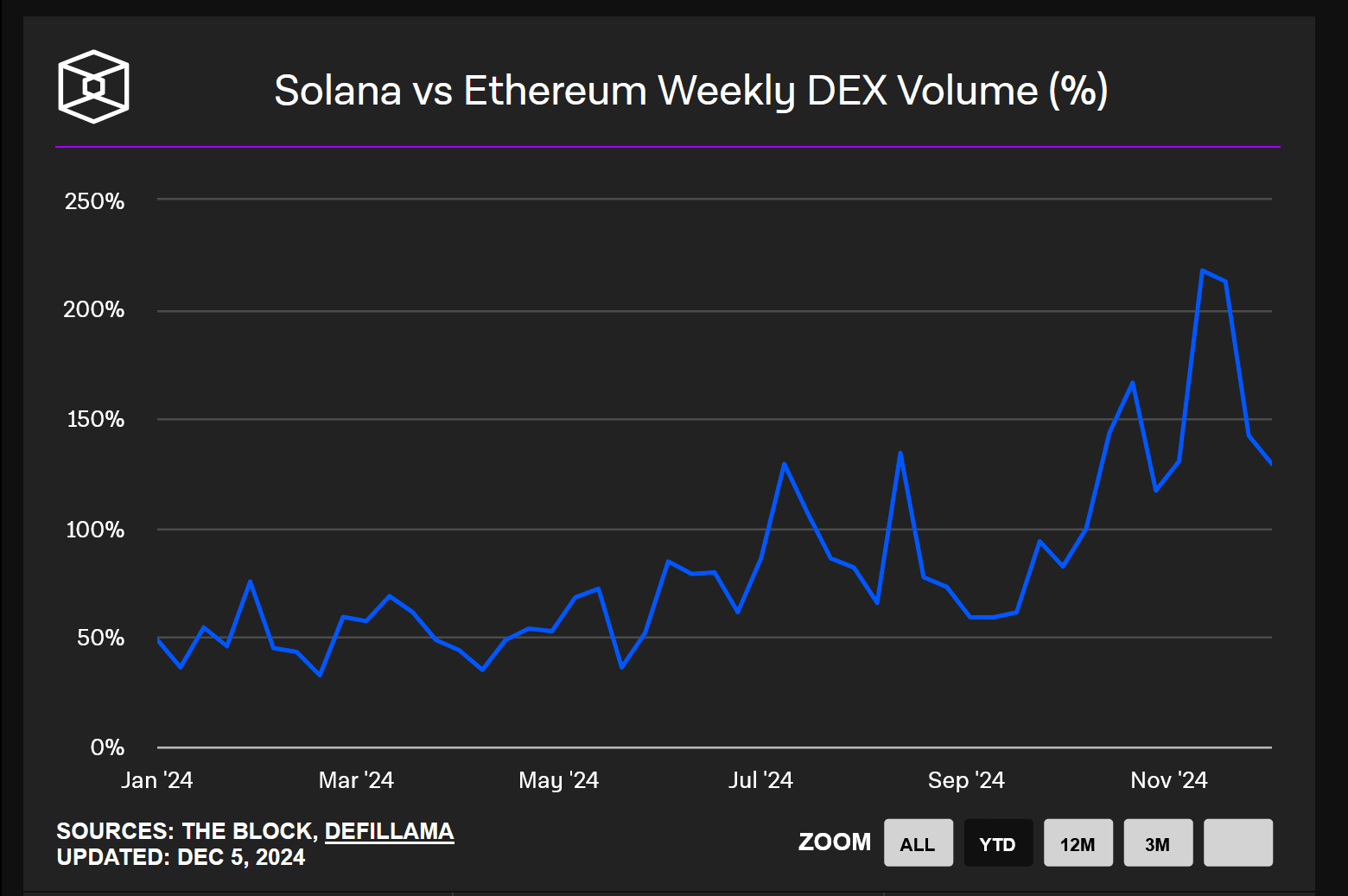

Now, it’s more than just derivatives—2024’s meme-coin craze brought a wave of new traders and unprecedented trading volume, cementing Solana as the de facto on-chain trading venue. In November 2024, Solana’s DEX volume was more than double Ethereum’s, and with >80% of the new tokens list and 135M active users in the same month, Solana has been the center of memecoin activity and innovation.

Yet, while Solana has become the chain of choice for traders, its technology and infrastructure haven’t evolved as quickly to match the sophistication and demands of this growing trader base.

Why Solana’s Infra Falls Short:

High Latency: ~400ms latency significantly lags behind Binance’s ~20ms.

Congestion Risks: Transaction failures or delays often occur during critical market movements.

Order Reliability Issues: Missed or unreliable take-profits and stop-losses undermine trading strategies.

Cumbersome Transaction Signing: Manually signing every transaction is impractical for high-speed trading.

Liquidity Challenges: Market makers face unique hurdles providing liquidity on the Solana L1, leading to wider spreads and worse prices for traders:

Non-Deterministic Transactions: Quoting tight spreads becomes risky due to unpredictability.

High Costs: Operating costs average ~2-3 SOL/day per market maker on exchanges like Zeta meaning only big players can participate.

Operational Complexity: Custom RPC infrastructure deters all but the most technically proficient participants.

Existing Exchange Models Aren’t Enough for Professional Traders:

Solana’s current platforms, designed to work within the complexities and limitations of its L1 outlined above, fail to deliver the professional-grade experience demanded by users of platforms like Hyperliquid:

Jupiter’s AMM limits listings to just 3 major assets and suffers from unavoidable AMM slippage.

Drift’s hybrid model (AMM + DLOB + RFQ) delivers unfavourable pricing: large AMM trades face heavy slippage, the DLOB forfeits price-time priority for limit orders, and RFQ fills take several seconds.

Zeta v2’s liquidity, beyond $SOL, also needs a significant upgrade.

On top of that, all of them are regularly affected by L1 congestion.

The Bottom Line:

Solana’s L1 infrastructure and exchange protocol models currently lack the ability to deliver a trading platform that offers the speed, reliability, competitive pricing, deep liquidity, and asset variety demanded by professional traders.

Both OG and new traders who have thrived on Solana this cycle now face a difficult decision:

Stick with Solana and tolerate subpar trading experiences.

Leave for centralized platforms or other chains, sacrificing decentralization and the unique ecosystem advantages of being at the epicenter of this cycle’s innovation, volume, and wealth generation.

We believe addressing these infrastructure and exchange protocol limitations is crucial for us to keep traders on Solana and maintain its status and growth trajectory as the traders’ chain.

The Solution: Zeta X

That is why we are building Zeta X, a professional-grade exchange purpose-built on a trading-optimized Solana Layer 2, delivering the tools and infrastructure professional traders need:

Dedicated Blockspace: Zero congestion from L1 ensures uninterrupted trading.

Ultra-Fast Execution: Orders are executed instantly in under 5ms—faster than even CEXs.

Integrated CLOB: A state-of-the-art central limit order book embedded in the L2, capable of processing thousands of orders per second, ensures competitive, professional-grade pricing.

Deep Liquidity: Faster, more reliable infrastructure and institutional-grade connectivity with robust APIs means seamless market maker liquidity provision.

Innovative Asset Listing: Innovative vaults unlock liquidity for long-tail assets, expanding trading opportunities.

Coming Soon

The Zeta X testnet launches in January 2025. Join us in building the next evolution of trading on Solana.

How Zeta X Will Stack Up to Hyperliquid